Glebors is the leading business and financial news network with plenty of special topics, which deeply analyses economic dynamic and accurately foresees and predicts economic trend.

Chinese governmnet has announced some economic stimulus since September

Electric car race is heating up in China, Chinese electric car companies that are already engaged in intense price war are turning up heat on another front, which is chip-powered tech features.

Despite growing calls for more stimulus measures, the magnitude of the easing policies that have been revealed is far from satisfying.

China will hold a highly anticipated meeting to reveal fiscal stimulus, which may include more monetary policy to support embattled property market as well as consumption.

Deteriorating Chinese economic fundamentals have produced deflationary pressures that are already moderating inflation both in China

Economic transition, the most oft-referenced topic, is the most pressing issue for China

Concerns have been growing over the potential ripple effect of a prolonged slowdown in China

Slowing the pace of stimulative measures would ultimately dampen the confidence of businesses

China’s state-directed economy may be creating the conditions for a new wave of bond defaults that could come as soon as next year

The once-massive sector has dragged down the economy, while the property sector is showing significant signs of turningpoint

How to drive the economy to recover sustainably from the pandemic is the overriding concern among the economists.

Economic transition, the most oft-referenced topic, is the most pressing issue for China. It is definitely not an overstatement to say that China economy is on the brink of abyss

What a healthy capital market requires is relatively fair trading environment. How to create a level playing field is the overriding concern for the average investors

Investos may also be positive on sectors that are important to China’s national development objectives, such as batteries, new energy vehicles and renewable energy

Upgrade technology hardware sector to overweight from underweight. Tech hardware, which has seen close to a 40% cut in earnings in the last two years, could reverse the downward trend in 2024 on global restocking and specific product cycles

Investors are looking to the Third Plenum of the 20th Central Committee of the Chinese Communist Party — a meeting that’s likely to happen before the end of this year — for more policy cues

One of the most unacceptable trading system in China equity market is "T+1”.That is to say, stocks or funds purchased by investors cannot be sold on the same day, only be sold after transfer on the next day

After long term declining, China equity market hit an important bottom in Feb 2024 and kicked off its rally.So far the path for the rally is a bumpy road due to lack of liquidity

After a short term rally, the market fall into the rut, consolidating around 3.000 points which is an important psychological threashold for investors

China equity market has undergone several times boom and depressions since founded in 1992, and has been hovering around 3.000 points in more than ten years

So far China economic recovery has not lived up to the expectation, the growrh is mainly driven by exports and manufacturing

During the process of exiting, the compensation to investors who suffer from the exiting of companies and the capital resources are in the spotlight

During the process of exiting, the compensation to investors who suffer from the exiting of companies and the capital resources are in the spotlight.

After a short term rally and testing the stress position, the equity market falls into a rut, indicating the market is still struggling

Undoubtedly, AI will transform the world in a revolutionary way, but this change is not welcomed by everyone. The truth is, with the rapid development of AI, thousands and thousands of jobs will be replaced around the world,no matter if you believe it.

To be honest, the competition in the predominance of currency is self-evident amid headwinds for the US dollar. Multiple negative factors including concerns over the US deficit, flip-flopping tariff policy as well as the threats to the independence of the Fed is dampening the sentiment around the greenback.

It seems Starbucks, a household name for consumers, is implementing a turnaround strategy, while the coffee chain company reported its quarterly earnings as well as sixth straight quarter of same-store sales declines.

It seems that demand for air taxis, which take off and land like helicopters do, has gained momentum in recent years. Despite the service faces regulatory and safety hurdles, but air taxis have been praised for its ability to cut traffic congestion and slash emissions.

The emergence of AI is disrupting and shaking up many industries and driving industry consolidation, including advertising market.

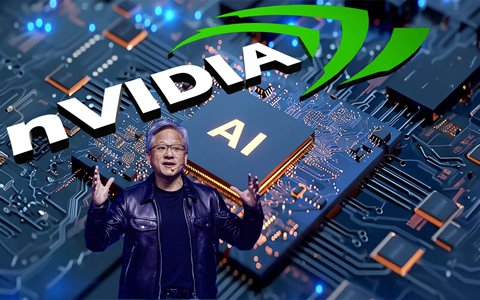

It is expected that over the next few years, big cloud companies and countries alike are poised to spend hundreds of billions of dollars to build new data center clusters

UK has been touting its potential as global AI player in recent months, amid Prime Minister Keir Starmer's efforts to lead the government with a growth-focused agenda.

It seems multiple uncertainties have not impacted the business of Nvidia materially. Shares of AI chipmaker Nvidia has surged nearly 24% over the past month

Amid volatile markets given flip-flopping tariff policy and earning season, investor sentiment by large extent is impacted by the uncertainty around earnings of major US companies and policy changes.

It seems the market's enthusiasm around AI has waned since President's "Liberation Day" on Apr2. The unexpected consequence of the tariff over the past month is the dampened investor mood over AI.

It seems Tesla's CEO Elon Musk's incendiary rhetoric and political activities have made a dent to Tesla's brand value and reputation, which have declined since 2024.

The rising budget deficit is back in the spotlight as well as on the forefront of investors' minds. Negative headline is weighing on the markets, which however can provide a buying opportunity.

It seems the market's enthusiasm around AI has waned since President's "Liberation Day" on Apr2. The unexpected consequence of the tariff over the past month is the dampened investor mood over AI.

Apple, which is the once bellwether of markets is running out of the steam, and the continuous decline in Apple's share is the combination of multiple intertwined factors, involving market competition, strategic adjustments

AI will transform the world in a revolutionary way, but this change is not welcomed by everyone. With the rapid development of AI, thousands and thousands of jobs will be replaced around the world,no matter if you believe it

After prolonged regulatory scrutiny, Didi Globle began to recover from its regulatory challenges in early 2023 when it received permission to relaunch its apps

China, the world’s second-largest economy behind the U.S is a key driver in the global economic expansion. China has been such a huge driver of growth and so negative for growth over the last year or two

Top executives of China enterprises have been meeting with top officials of Malaysia government to seek guarantee to aviud U.S.tariffs if they move the manufacturing base to Malaysia

The company had confidentially filed for a U.S. initial public offering in November but began looking toward London after it failed to win the support of American lawmakers